One app, endless possibilities. Pay, trade, earn rewards, and grow your money-your way, all in one powerful app

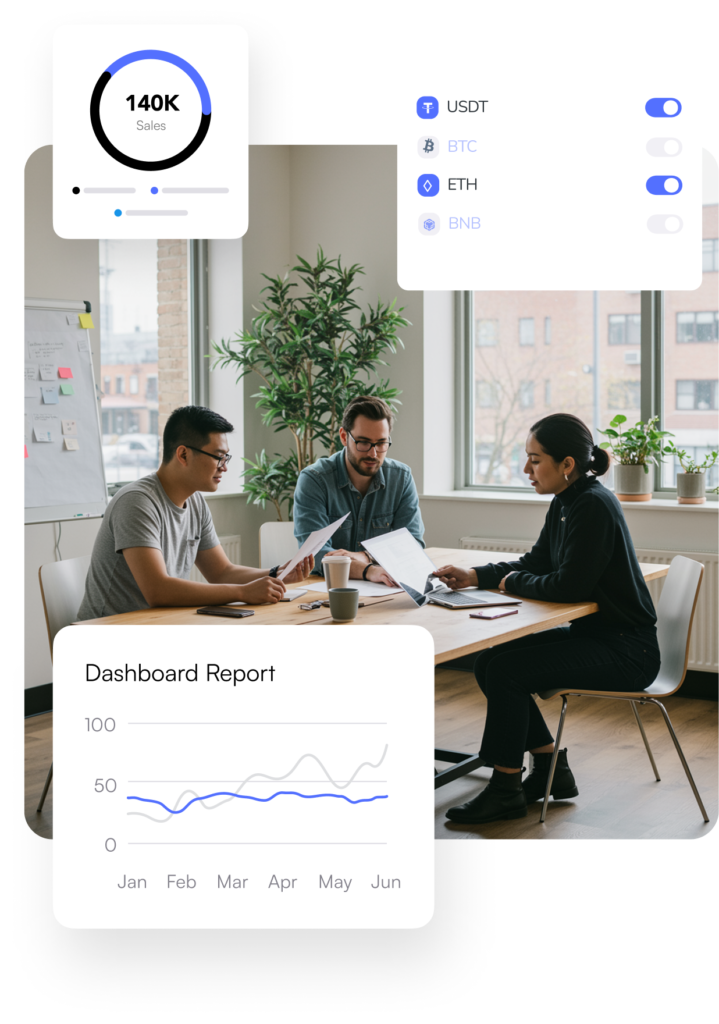

PalWallet empowers businesses with advanced financial tools to boost growth, streamline payments, launch branded cards, and integrate crypto services-scaling made easy.

PalWallet provides secure, next-generation financial tools designed to help businesses scale and users take full control of their finances while unlocking new opportunities.

One app, endless possibilities. Pay, trade, earn rewards, and grow your money-your way, all in one powerful app

Manage and grow your money

Purchase crypto instantly

Transfer funds wordwide

Access Supported Coins

Pay globally with ease

Earn on every spend

Earn on every spend

Invite friends, get rewards.

PalWallet empowers businesses with advanced financial tools to boost growth, streamline payments, launch branded cards, and integrate crypto services-scaling made easy.

Business Money Management

Multi-account management

Custom card solutions

Crypto payment integration

Seamless payment processing

Branded banking services

PalWallet provides secure, next-generation financial tools designed to help businesses scale and users take full control of their finances while unlocking new opportunities.

Instant customer support

Insights and updates

Share your thoughts

Get in touch

One app, endless possibilities. Pay, trade, earn rewards, and grow your money-your way, all in one powerful app

PalWallet empowers businesses with advanced financial tools to boost growth, streamline payments, launch branded cards, and integrate crypto services-scaling made easy.

PalWallet provides secure, next-generation financial tools designed to help businesses scale and users take full control of their finances while unlocking new opportunities.

One app, endless possibilities. Pay, trade, earn rewards, and grow your money-your way, all in one powerful app

PalWallet empowers businesses with advanced financial tools to boost growth, streamline payments, launch branded cards, and integrate crypto services-scaling made easy.

PalWallet provides secure, next-generation financial tools designed to help businesses scale and users take full control of their finances while unlocking new opportunities.

PalWallet

Last updated: January 2026

1. Introduction

PalWallet is committed to maintaining the highest standards of compliance with international Anti-Money Laundering (AML), Counter-Terrorist Financing (CTF), and Know Your Customer (KYC) regulations.

This policy outlines the principles, controls, and procedures implemented to prevent the use of PalWallet’s platform for money laundering, terrorist financing, fraud, and other financial crimes.

PalWallet operates in accordance with applicable laws and regulatory requirements in all jurisdictions where its services are provided.

2. Regulatory Framework

PalWallet’s AML and KYC framework is aligned with international standards and regulations, including but not limited to:

• Financial Action Task Force (FATF) Recommendations

• EU Anti-Money Laundering Directives (AMLD)

• Markets in Crypto-Assets Regulation (MiCA)

• Local financial crime and AML legislation in supported jurisdictions

• Sanctions and watchlists issued by OFAC, EU, UN, and other authorities

3. Scope of Policy

This policy applies to:

• All PalWallet users

• All PalWallet products and services

• All employees, contractors, and partners

• All fiat and crypto transactions conducted on the platform

4. Customer Due Diligence (KYC)

PalWallet applies a risk-based approach to customer verification.

4.1 Identity Verification

All users must complete identity verification before accessing regulated services. This includes:

• Full legal name

• Date of birth

• Nationality

• Residential address

• Government-issued photo ID

• Liveness and biometric verification

• Proof of address where required

Business users must provide:

• Company registration documents

• Beneficial ownership details

• Director and shareholder information

• Business activity description

4.2 Risk Assessment

Each customer is assessed based on:

• Country of residence

• Transaction behaviour

• Source of funds

• Politically Exposed Person (PEP) status

• Sanctions exposure

• Business activity risk

Higher-risk customers may be subject to Enhanced Due Diligence (EDD).

5. Enhanced Due Diligence (EDD)

EDD is applied to high-risk users including:

• Politically Exposed Persons

• High-volume traders

• Users from high-risk jurisdictions

• Complex ownership structures

EDD measures may include:

• Source of funds verification

• Source of wealth verification

• Additional documentation

• Ongoing monitoring

6. Transaction Monitoring

PalWallet operates continuous transaction monitoring using automated and manual controls.

Monitoring includes:

• Unusual transaction patterns

• Rapid movement of funds

• Structuring or layering behaviour

• High-risk wallet interactions

• Sanctioned wallet screening

• Blockchain analytics and tracing

Suspicious activity is flagged, reviewed, and escalated where necessary.

7. Sanctions and Watchlist Screening

All users and transactions are screened against global sanctions lists, including:

• OFAC

• EU Sanctions

• UN Sanctions

• UK HMT

• Interpol and law enforcement databases

Users linked to sanctioned entities are blocked immediately.

8. Suspicious Activity Reporting

PalWallet maintains internal procedures for identifying and reporting suspicious activity.

Where required by law, PalWallet files Suspicious Activity Reports (SARs) or Suspicious Transaction Reports (STRs) with relevant authorities.

PalWallet cooperates fully with regulators and law enforcement agencies.

9. Record Keeping

PalWallet retains customer and transaction records in accordance with regulatory requirements, typically for a minimum of five years.

Records include:

• KYC documentation

• Transaction history

• Risk assessments

• Compliance reviews

• Audit logs

10. Data Protection and Privacy

All personal data is processed in accordance with applicable data protection laws including GDPR.

User data is:

• Encrypted

• Stored securely

• Access-controlled

Used only for regulatory and operational purposes

11. Staff Training and Compliance Oversight

All PalWallet staff receive regular AML and KYC training.

A designated Compliance Officer is responsible for:

• Oversight of AML and KYC programmes

• Regulatory reporting

• Policy enforcement

• Internal audits

• Regulatory liaison

12. Ongoing Monitoring and Review

This policy is reviewed regularly to ensure continued compliance with:

• Regulatory changes

• Industry best practices

• Emerging financial crime risks

• Technological developments

13. Zero Tolerance Policy

PalWallet maintains a zero-tolerance approach to financial crime.

Any attempt to misuse the platform for illegal activity will result in:

• Account suspension or termination

• Asset freezing where legally required

• Reporting to authorities

14. Contact

For compliance-related inquiries, please contact:

Compliance Team PalWallet

Email: [email protected]

Whether you’re just getting started or looking for specifics on features like spending limits, card security, international usage, fees, or managing your crypto-linked payments our FAQ section covers it all.

PalWallet is a next-generation crypto wallet and payment app that lets you store, send, receive, and swap cryptocurrencies, as well as spend globally using your PalCard. It supports both crypto and fiat, giving you full control of your digital assets in one easy-to-use app. Whether you’re a casual holder or a frequent user, PalWallet simplifies Web3 finance.

Yes. PalWallet offers bank-grade security, including multi-signature architecture, biometric access, and insurance-backed wallets. We also comply with EU-level regulatory standards, ensuring that your funds and data are protected at every layer.

Absolutely. With PalWallet, you can send and receive crypto across borders instantly, with low fees and no hidden charges. It’s perfect for freelancers, digital nomads, or anyone sending money globally in Bitcoin, Ethereum, or stablecoins.

Yes. PalWallet is a hybrid wallet that supports major cryptocurrencies and traditional fiat currencies, making it ideal for users who want to manage digital and traditional money in one place. You can also convert between crypto and fiat with our built-in swap feature.

PalSwaps lets you exchange crypto instantly with low fees, while PalSave allows you to earn passive rewards by holding your crypto. Both features are designed to maximize your crypto’s potential without needing complex DeFi tools or exchanges.

Yes. PalWallet is designed to be simple enough for beginners and powerful enough for experts. Whether you’re just getting started or managing a portfolio, you’ll find intuitive features like one-click swaps, asset tracking, and advanced wallet settings.

Yes. PalWallet operates under a crypto license from Europe and partners with regulated banking institutions for fiat services. Your funds are insured up to certain limits, and all transactions meet AML/KYC compliance. We take your financial security seriously.

Enterprise teams can build with PalPayments. Consumers can start with PalWallet and PalCard.

Past performance is not a reliable indicator of future results. Investing in blockchain-based assets carries a risk of partial or total loss of capital. The value of any digital assets exchanged through PalWallet is subject to market volatility and other financial risks.

© PalWallet, PalWallet Limited

See Also

Support

FAQ

Blog

Affiliates Program

Crypto Services

Buy Crypto

Crypto Saving

Crypto Swaps

Crypto Staking

Crypto Prices

Over The Counter

For Startups

Looking for funding?

Multi-Chain

Polygon (MATIC)

Avalanche (AVAX)

Arbitrum (ARB)

Tron (TRX)

Polkadot (DOT)

Tezos (XTZ)

PalWallet vs Trust Wallet

PalWallet vs MetaMask

PalWallet vs Coinbase Wallet

PalWallet vs Binance Wallet

For Business Hybrid FinancePalPayments DeFi

CeFi

Crypto Assets

Bitcoin wallet

Ethereum wallet

Solana wallet

Cardano wallet

XRP wallet

Monero wallet

USDT wallet

Past performance is not a reliable indicator of future results. Investing in blockchain-based assets carries a risk of partial or total loss of capital. The value of any digital assets exchanged through PalWallet is subject to market volatility and other financial risks.

© PalWallet, PalWallet Limited

Crypto Services

Buy Crypto

Crypto Saving

Crypto Swaps

Crypto Staking

Crypto Prices

Over The Counter

For Startups

Looking for funding?

Multi-Chain

Polygon (MATIC)

Avalanche (AVAX)

Arbitrum (ARB)

Tron (TRX)

Polkadot (DOT)

Tezos (XTZ)

PalWallet vs Trust Wallet

PalWallet vs MetaMask

PalWallet vs Coinbase Wallet

PalWallet vs Binance Wallet

For Business Hybrid FinancePalPayments DeFi

CeFi

Crypto Assets

Bitcoin wallet

Ethereum wallet

Solana wallet

Cardano wallet

XRP wallet

Monero wallet

USDT wallet

Legal & Regulatory Information

The PalWallet Account and PalCard (Mastercard) are issued by a regulated money provider, an Electronic Money Institution authorised by the Central Bank of Cyprus under the Electronic Money Law. The regulated money provider is a member of the Mastercard network. Please note that electronic money products are not covered by the Deposit Insurance Scheme of the Republic of Cyprus. However, all client funds are safeguarded in segregated accounts, ensuring that in the unlikely event of the provider’s insolvency, your funds remain protected from claims by creditors.

Mastercard Disclaimer

The Mastercard circles design is a registered trademark of Mastercard International Incorporated.

Apple Pay Disclaimer

Apple Pay is a trademark of Apple Inc. and is provided by Apple Payments Services LLC, a subsidiary of Apple Inc. Apple Inc. and its subsidiaries are not banks. Any card added to Apple Pay is issued by your card provider, not by Apple.

Google Pay Disclaimer

Google Pay and Google Wallet are trademarks of Google LLC. Use of these services is subject to Google’s terms and conditions.Contactless Indicator

The Contactless Indicator mark, consisting of four graduating arcs, is a trademark owned by and used with permission of EMVCo, LLC.OtherThe PalWallet Account and PalCard

© PalWallet, PalWallet Limited

Past performance is not a reliable indicator of future results. Investing in blockchain-based assets carries a risk of partial or total loss of capital. The value of any digital assets exchanged through PalWallet is subject to market volatility and other financial risks.

© PalWallet, PalWallet Limited

Crypto Services

Buy Crypto

Crypto Saving

Crypto Swaps

Crypto Staking

Crypto Prices

Over The Counter

For Startups

Looking for funding?

Multi-Chain

Polygon (MATIC)

Avalanche (AVAX)

Arbitrum (ARB)

Tron (TRX)

Polkadot (DOT)

Tezos (XTZ)

Get Started

PalWallet vs Trust Wallet

PalWallet vs MetaMask

PalWallet vs Coinbase Wallet

PalWallet vs Binance Wallet

For Business Hybrid Finance

PalPayments DeFi

CeFi

Crypto Assets

Bitcoin wallet

Ethereum wallet

Solana wallet

Cardano wallet

XRP wallet

Monero wallet

USDT wallet

Legal & Regulatory Information

The PalWallet Account and PalCard (Mastercard) are issued by a regulated money provider, an Electronic Money Institution authorised by the Central Bank of Cyprus under the Electronic Money Law. The regulated money provider is a member of the Mastercard network. Please note that electronic money products are not covered by the Deposit Insurance Scheme of the Republic of Cyprus. However, all client funds are safeguarded in segregated accounts, ensuring that in the unlikely event of the provider’s insolvency, your funds remain protected from claims by creditors.

Mastercard Disclaimer

The Mastercard circles design is a registered trademark of Mastercard International Incorporated.

Apple Pay Disclaimer

Apple Pay is a trademark of Apple Inc. and is provided by Apple Payments Services LLC, a subsidiary of Apple Inc. Apple Inc. and its subsidiaries are not banks. Any card added to Apple Pay is issued by your card provider, not by Apple.

Google Pay Disclaimer

Google Pay and Google Wallet are trademarks of Google LLC. Use of these services is subject to Google’s terms and conditions.Contactless Indicator

The Contactless Indicator mark, consisting of four graduating arcs, is a trademark owned by and used with permission of EMVCo, LLC.OtherThe PalWallet Account and PalCard

© PalWallet, PalWallet Limited